Define Bank:

You can define a bank or a clearinghouse. Define Banks to record internal banks, where you are the account holder of a receipt and/or disbursement account. If you use Payables, you can define external

banks where your suppliers are the account holders. Also, if you use Oracle Receivables, define banks to record external banks where your customers are the account holders of disbursement accounts. Define

Clearing Houses to record banks that process a magnetic tape of your receipt information, which you send to them. These clearing institutions then create tapes of your customer receipt information, which they forward to each of your remittance banks.

Setups for Defining the Banks

1.Define Grants and Roles:

Navigation: User Management --> Role & Role Inheritance.

Select the User Management Responsibility.

You can define a bank or a clearinghouse. Define Banks to record internal banks, where you are the account holder of a receipt and/or disbursement account. If you use Payables, you can define external

banks where your suppliers are the account holders. Also, if you use Oracle Receivables, define banks to record external banks where your customers are the account holders of disbursement accounts. Define

Clearing Houses to record banks that process a magnetic tape of your receipt information, which you send to them. These clearing institutions then create tapes of your customer receipt information, which they forward to each of your remittance banks.

Setups for Defining the Banks

1.Define Grants and Roles:

Navigation: User Management --> Role & Role Inheritance.

Select the User Management Responsibility.

Click on Roles & Role Inheritance.

Enter Type, Category and Name of the payable responsibility name and click on GO.

Click on Update.

Click on Security Wizards.

Click on Security Wizards.

Click on Save and Proceed.

Click on CE UMX Security Wizard.

Click on CE UMX Security Wizard.

Click on Add Legal Entities.

Select Bank Account Grants Use, Maintenance, Bank Account Transfers, and then click on Apply.

Click on Apply.

2. Define Bank.

Navigation: Payable Manager --> Setup --> Payments --> Bank and Branches.

Click on Bank tab.

Click on Create.

2. Define Bank.

Navigation: Payable Manager --> Setup --> Payments --> Bank and Branches.

Click on Bank tab.

Click on Create.

Enter the Country and Bank Name and then click on Save and Next button.

If you want enter the bank address then enter required the information.

Click on Save and Next.

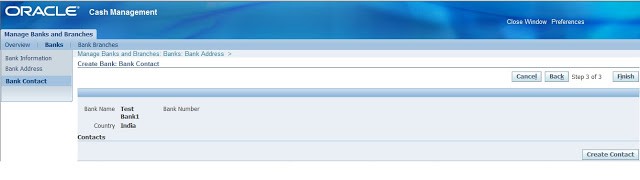

If you want enter the contacts details of the bank then enter the information.

Click on Finish

Define Branch:

Click on Create Branch.

Define Branch:

Click on Create Branch.

Click on Continue.

Enter Branch Name Branch Type and then click on save and next button.

Enter the branch address details and then click on save and next button.

Enter the branch contact details and then click on Finish .

Define Bank Account:

Click on Create Bank Account.

Click on Continue.

Select the Legal entity and Enable modules, which we want to use this bank account.

Click on Next.

Enter the Bank account Name, Number and currency and then click on save and next.

Enter the cash and cash clearing accounts and then click on save and next button.

Add Operating unit to your bank

Click on Add Organization Access.

Enable Account use for Payable, Receivables, Organization Name, and then click on Continue.

Click on Apply.

Click on Finish.

Defining Internal Bank Accounts:

You define internal bank accounts to define bank accounts for which you are the account holder. Oracle Receivables uses internal bank accounts to receive payments from customers. Oracle Payables uses

internal bank accounts to disburse funds to suppliers.

Prerequisite

§ You

have installed Oracle Receivables.

§ Define

custom payment formats for Payables payment documents

To define a basic bank account for receipts:

1. In the Banks window query an existing Bank.

2. Choose the Bank Accounts button. Enter the Bank Account Name and Bank Account Number. Optionally enter an Account Type and Description.

3. If you want to use Bank Account validation, enter Check Digits.

4. Select Internal Account Use.

5. In the GL Accounts region, enter a Cash Account.

6. In the Receivables Options region, enter GL Account information for Remitted Receipts, Factored Receipts, and Short Term Debt.

7. In the More Receivables Options region, optionally enter Receipt and Discount GL Account information.

8. Optionally enter the contact information in the

Contact region.

9. Save your work.

9. Save your work.

Prerequisite

§ You

have installed Payables

To define a basic bank account for

disbursements:

1. In the Banks window query an existing Bank.

2. Choose Bank Accounts. Enter the Bank Account Name and Bank Account Number. If you will use this bank for payments you make with the EDI Gateway, enter an Account Type. Optionally enter a Description. The currency defaults from your functional currency. If you want to use Bank Account validation, enter Check Digits.

3. Select Internal Account Use.

4. In the GL Accounts region, enter a Cash Account.

5. In the Payables Options region, enter default information for your payment batches. Record whether you allow zero–amount payments and whether this is a pooled account.

6. Optionally enter the contact information in the Account Contacts region.

7. Proceed with Defining and Maintaining Payables Payment

Defining Customer Bank Accounts

1. In the Banks window query an existing Bank.

2. Choose Bank Accounts. Enter the Bank Account Name and Bank Account Number. If you will use this bank for payments you make with the EDI Gateway, enter an Account Type. Optionally enter a Description. The currency defaults from your functional currency. If you want to use Bank Account validation, enter Check Digits.

3. Select Internal Account Use.

4. In the GL Accounts region, enter a Cash Account.

5. In the Payables Options region, enter default information for your payment batches. Record whether you allow zero–amount payments and whether this is a pooled account.

6. Optionally enter the contact information in the Account Contacts region.

7. Proceed with Defining and Maintaining Payables Payment

Defining Customer Bank Accounts

If you use Oracle Receivables, you can enter

bank account information for your customers. Receivables use this information

when you receive electronic payments from your customers.

To define a customer bank account:

1. In the Banks window query an existing Bank.

2. Choose the Bank Accounts button. Enter the Bank Account Name and Bank Account Number. Optionally enter an Account Type and Description.

3. Select Customer Account Use.

4. Optionally enter the contact information in the Contact region.

5. Save your work.

To define a customer bank account:

1. In the Banks window query an existing Bank.

2. Choose the Bank Accounts button. Enter the Bank Account Name and Bank Account Number. Optionally enter an Account Type and Description.

3. Select Customer Account Use.

4. Optionally enter the contact information in the Contact region.

5. Save your work.

Defining Supplier Bank Accounts

You can enter information for bank accounts for which your supplier is the account holder. You then assign these accounts to the supplier and its sites. Payables use this bank information when you create electronic payments for your suppliers.

You can enter information for bank accounts for which your supplier is the account holder. You then assign these accounts to the supplier and its sites. Payables use this bank information when you create electronic payments for your suppliers.

Prerequisite

§ Define

the suppliers and supplier sites that use the bank account to receive

electronic payments.

To define a supplier bank account:

1. In the Banks window query an existing Bank.

2. Choose the Bank Accounts button. Enter the Bank Account Name and Bank Account Number. Enter the EDI ID number. Optionally enter an Account Type and Description. Optionally change the account currency, which defaults from your functional currency. If you want to use Bank Account validation, enter Check Digits.

3. Select Supplier as the Account Use.

4. In the Supplier Assignments region list the supplier, and optionally list supplier sites, that use the account to receive electronic payments.

5. Optionally enter account holder information in the Account Holder region. Optionally enter the contact information in the Account Contacts region.

6. Save your work.

7. In the Bank Accounts region of the Suppliers and Supplier Sites windows, verify for each supplier and site that all appropriate bank accounts are listed. For suppliers and supplier sites with multiple bank accounts, designate as the primary bank account one bank account per period and per currency.

1. In the Banks window query an existing Bank.

2. Choose the Bank Accounts button. Enter the Bank Account Name and Bank Account Number. Enter the EDI ID number. Optionally enter an Account Type and Description. Optionally change the account currency, which defaults from your functional currency. If you want to use Bank Account validation, enter Check Digits.

3. Select Supplier as the Account Use.

4. In the Supplier Assignments region list the supplier, and optionally list supplier sites, that use the account to receive electronic payments.

5. Optionally enter account holder information in the Account Holder region. Optionally enter the contact information in the Account Contacts region.

6. Save your work.

7. In the Bank Accounts region of the Suppliers and Supplier Sites windows, verify for each supplier and site that all appropriate bank accounts are listed. For suppliers and supplier sites with multiple bank accounts, designate as the primary bank account one bank account per period and per currency.

Defining Multiple Currency Bank Accounts

If you define a multiple currency bank account, you should use manual payment reconciliation with it. Payables stores the payment currency you enter when you initiate a Payment Batch, enter a manual payment,

or create a Quick payment. The bank file details you receive from a bank will contain the bank account currency. Since the payment and bank, account currencies could differ when you use multiple currencies

bank account, automatic reconciliation could result in numerous exceptions.

If you define a multiple currency bank account for payments, the currency of the bank account must be the same as your functional currency.

If you define a multiple currency bank account, you should use manual payment reconciliation with it. Payables stores the payment currency you enter when you initiate a Payment Batch, enter a manual payment,

or create a Quick payment. The bank file details you receive from a bank will contain the bank account currency. Since the payment and bank, account currencies could differ when you use multiple currencies

bank account, automatic reconciliation could result in numerous exceptions.

If you define a multiple currency bank account for payments, the currency of the bank account must be the same as your functional currency.

Prerequisites

§ Enable

the Use Multiple Currencies Payables option.

§ Enable

the currencies you need in the Currencies window.

To define a multiple currency bank account:

1. Define a basic bank account for receipts or disbursements.

1. Define a basic bank account for receipts or disbursements.

• If you are defining a bank account for

receipts, in the Receivables

Options region, enable the Multiple Currency Receipts option.

• If you are defining a bank account for disbursements, in the

Payables Options region, enable the Multiple Currency Payments

option and enter Realized Gain and Realized Loss accounts.

Payables Setup 2 – 123

Proceed with Defining and Maintaining Payables Payment

Documents: page 2 – 124. You can define payment documents

that use a payment format with any currency.

2. Save your work.

Defining Foreign Currency Bank Accounts

Prerequisites

q Enable the Use Multiple Currencies Payables option.

q Enable the currencies you need in the Currencies window. See:

Currencies Window (Oracle Applications System Administrator’s

Guide).

To define a foreign currency bank account:

1. Define a basic bank account for receipts or disbursements.

Options region, enable the Multiple Currency Receipts option.

• If you are defining a bank account for disbursements, in the

Payables Options region, enable the Multiple Currency Payments

option and enter Realized Gain and Realized Loss accounts.

Payables Setup 2 – 123

Proceed with Defining and Maintaining Payables Payment

Documents: page 2 – 124. You can define payment documents

that use a payment format with any currency.

2. Save your work.

Defining Foreign Currency Bank Accounts

Prerequisites

q Enable the Use Multiple Currencies Payables option.

q Enable the currencies you need in the Currencies window. See:

Currencies Window (Oracle Applications System Administrator’s

Guide).

To define a foreign currency bank account:

1. Define a basic bank account for receipts or disbursements.

• If you are defining a bank account for

disbursements, in the Payables Options region, enter Realized Gain and Realized

Loss of Accounts.

2. Save your work.

2. Save your work.

No comments:

Post a Comment